The Central Bank of Malta’s business conditions index indicates mixed economic signals, as September’s annual growth in business activity declined slightly, falling just below the long-term average.

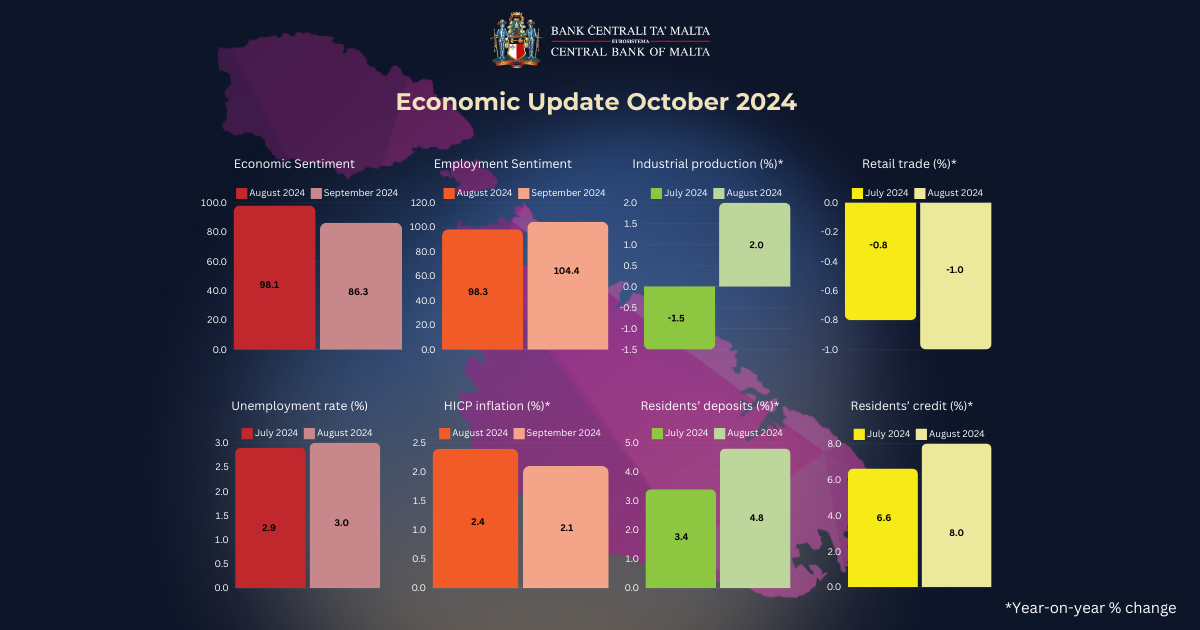

Additionally, the European Commission’s economic sentiment indicator for Malta also saw a decrease, remaining below its long-term average. However, there was a positive shift in employment expectations, with the indicator rising in September and surpassing its long-term average.

Price expectations increased across all sectors, except among consumers. The largest increase was recorded by the retail sector.

Developments in activity indicators were mixed. In August, industrial production rose while retail trade contracted on a year earlier. In July, services production accelerated on a year-on-year basis. Unemployment remained low from a historical perspective. It increased marginally when compared with the preceding month but remained below the rate from a year earlier.

In August residential permits were above their year-ago level. In September, both the number of residential promise-of-sale agreements and the number of final deeds were above those of a year earlier.

During the 12 months to August, annual growth in Maltese residents’ deposits, forming part of the broad monetary aggregate M3, accelerated. Annual growth in credit to Maltese residents, rose at a faster pace when compared to the preceding month, reflecting higher growth rate in credit to general government.

In September, the annual inflation rate based on the Harmonised Index of Consumer Prices (HICP) fell to 2.1 per cent. While overall inflation in Malta exceeded the euro area average, HICP inflation excluding food and energy stood at 1.9 per cent – well below the corresponding rate in the euro area. According to the Retail Price Index (RPI), inflation in September dipped to 1.2 per cent, from 1.5 per cent in August.

In August, the Consolidated Fund recorded a surplus, despite a large increase in Government expenditure. As a result, the surplus registered during the month was lower than that for the same month a year earlier.

The full economic update can be found here.

Housing Authority doubles vacant dwelling restoration grant to €50,000

Eligibility criteria also widened to include properties built 20 years ago

Workplace accidents remain high in Malta despite slight decline – construction still tops risk list

High-risk sectors continue to dominate injury statistics

Five and four star hotel occupancy edges up in 2025, MHRA survey finds

Five-star occupancy levels stood at 71 per cent in 2025, up slightly from 2024 levels