Just under four in 10 (39 per cent) of local businesses increased selling prices in the third quarter of 2021, according to the latest edition of the Central Bank of Malta (CBM)’s quarterly Business Dialogue Publication.

This came as cost pressures remained elevated during the period, with just under two thirds of businesses reporting that input prices have increased.

Almost half of businesses consulted said they’d kept selling prices the same, while 14 per cent reported reductions.

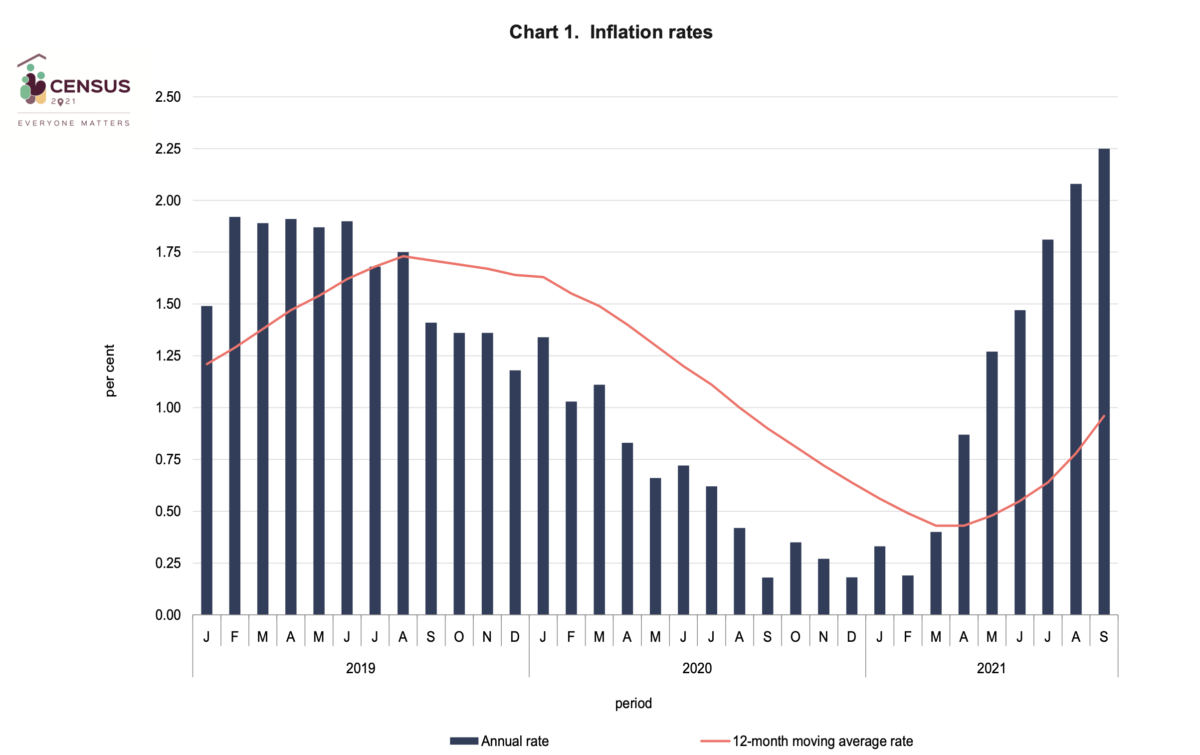

The findings tally with prior reports which revealed that prices in Malta are on the increase, as the country’s annual price inflation rate stood at 2.25 per cent in September, according to National Statistics Office (NSO) data.

The inflated prices come as the Government continues to scale back COVID-related economic support, and as global supply chain problems have a disproportionately hard impact on the import-reliant Maltese economy.

However, more generally, the CBM report indicated a positive economic outlook for Malta firms.

A significant majority (65 per cent) of firms experienced higher business activity during the quarter, compared to only 16 per cent that reported a decrease.

Looking to the future, almost half of firms interviewed indicated that they expect business activity to expand during the next three months, whereas 11 per cent predicted a decline.

Investment plans for companies remain on track, with 73 per cent of respondents saying they continued their investment plans as scheduled, compared to 14 per cent who reported postponement.

A notable portion of firms are also set to embark on a hiring spree, if they can find the staff, with 37 per cent planning to increase their staff complement, but more still expressing concerns about labour shortages.

The CBM report was based on information gathered between July and September 2021, consisting of 66 telephone/virtual interviews with leading non-financial corporations.

These included 16 manufacturing companies, 31 services-oriented companies, nine wholesale and retail companies, seven construction and real estate companies and three public/private institutions.

The full report can be accessed online.

KM Malta will start flying to Tel Aviv this summer

New route announced as part of KM Malta Airlines' largest summer schedule to date

Why the MLRO role matters more than ever

Matthew Scicluna and Eric Micallef from the MFSA’s Financial Crime Compliance function, shed light on the MLRO Guidance document

New EV leasing mechanism introduced for businesses

The arrangement will support the leasing of zero-emission vehicles without impacting the De Minimis State aid limits of leasing companies