The title of today’s article may be surprising for several retail investors due to the constant media headlines about the high levels of inflation in most parts of the world.

However, despite the clear need for the major central banks to hike interest rates further in the immediate future in order to suppress the level of inflation, several economists predict that we may indeed be nearing a time when bond yields are peaking. This is an important consideration not only for those investors exposed to the bond market but also all other investors who have a greater risk appetite and as a result have a large allocation to shares within their investment portfolios.

In fact, the publication of lower-than-expected inflation data in the US on Thursday sparked a massive rally in both the equity and bond markets globally late last week. The annual rise of the US consumer price index was reported at 7.7 per cent in October compared to a forecast for a rise of 8 per cent. This was the lowest 12-month increase since January 2022 and a sharp drop from an annual rate of 8.2 per cent in September. These inflation readings gave investors confidence that the sharp interest rate hikes by the Federal Reserve over recent months (the US central bank delivered four consecutive rate rises of 0.75 percentage points each) are already having the desired effect of taming inflation and as a result, the Federal Reserve will be easing the pace of future rate hikes.

Treasury yields in the US plunged after the data was released last Thursday while equity markets soared, most especially the share prices of technology companies. In fact, while the Dow Jones Industrial Average index jumped more than 1,200 points on Thursday (equivalent to a rise of 3.7 per cent), the S&P 500 index gained 5.5 per cent and the Nasdaq Composite surged about 7.4 per cent. The rally witnessed last Thursday ranks among the sharpest daily gains since 2020.

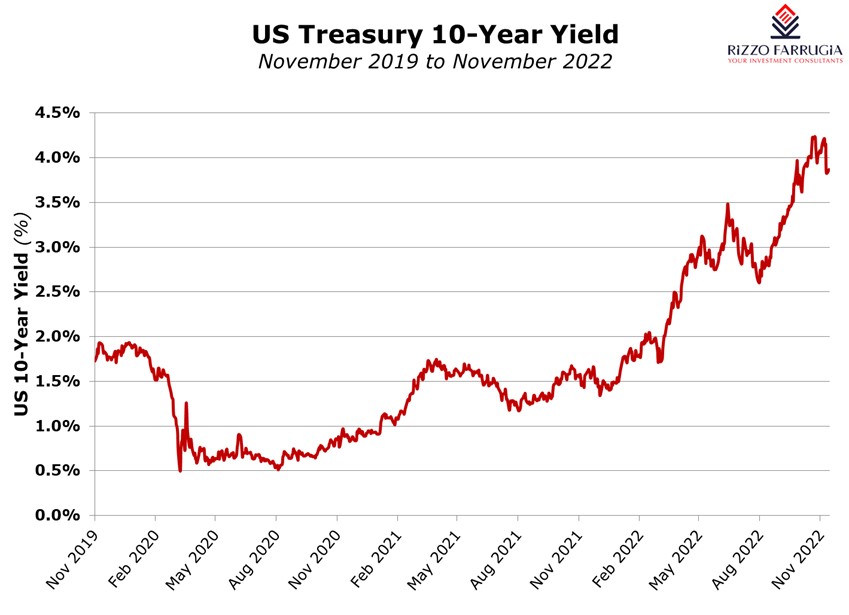

In the bond markets, the yield on the two-year Treasury note, which is particularly sensitive to interest rate movements, fell 0.25 percentage points to 4.33 per cent – its largest drop since October 2008. Since yields and bond prices move inversely, the decline in yields implies a significant rally in bond prices. Likewise, the yield on the 10-year US Treasury note fell to 3.828 per cent on Thursday from 4.149 per cent the prior day (the biggest daily decline since March 2009). A few weeks ago, the yield on the 10-year US Treasury note touched a multi-year high of 4.32 per cent.

Many investors may question the reasons for the significance of the movements in bond yields to the manner in which equity markets fluctuate. Equity markets reflect the valuations of companies and one of the most common ways to value a company is by using a discounted cash flow method. This attempts to calculate the value of a company today, based on estimates of the amount of cash it can generate in the future. This method relies on the principle that the value of money in the future is worth less than today. A discount rate is used as part of the calculation to translate future cash flows into a present-day value. The higher the discount rate used in the calculation, the lower the value attributable to future cash flows. The discount rate used in such valuations is typically based on the 10-year government bond yield, often referred to as the risk-free rate.

On this basis, rising yields negatively affects the current market value of companies whose valuations are based on high future cash flows (such as the high-growth technology companies). In fact, rising US Treasury yields (which jumped from around 1.50 per cent at the end of 2021 to above four per cent recently) and the resultant strengthening of the US dollar have been among the two main factors that led to the sharp downturn across equity markets. On the contrary therefore, the decline in yields experienced last week positively effects company valuations.

Another important consideration of higher yields on movements across the equity market is the relative attractiveness of bonds over shares. With yields at historically low levels over recent years, an increasing amount of investors were acquiring riskier investments such as shares in order to seek higher returns. However, as yields rise, some investors would tend to move away from shares into government or corporate bonds.

Although the inflation readings in Europe are still elevated and the European Central Bank will clearly continue to hike rates in the coming months, the developments in the US last Thursday also resulted in a decline in eurozone bond yields. The yield on the 10-year German bund, which is the benchmark for the eurozone, slumped from 2.16 per cent to below two per cent immediately upon the publication of the inflation reading in the US last Thursday. Last month, the yield on the 10-year German bund touched a multi-year high of 2.53 per cent.

Within the local context the movement in bond yields internationally and especially across the eurozone is important due to the daily pricing mechanism adopted by the Central Bank of Malta in its role as a ‘market maker’ for Malta Government Stocks. This in turn affects the pricing on the primary market for new Malta Government Stocks and indirectly also for corporate bonds. The notion that bond yields could be reaching peak levels is therefore important for investors to digest especially at a time of the numerous new issues concurrently taking place which is unprecedented by local market standards.

Read more of Mr Rizzo’s insights at Rizzo Farrugia (Stockbrokers)

The article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article.

Interest rate divergence ahead?

Inflation is falling faster than forecast in Europe, while exceeding expectations in the US

‘Made in China’ shock 2.0

To rebrand the local economy, China is now investing heavily in what president Xi Jinping calls the 'three new industries'

Sharp upturn across equity markets in Q1

The stock market's repeated strong recoveries highlights the importance for investors to have a long-term time frame