During the first six months of 2023, the monetary policy decisions by the major central banks remained, as expected, a major theme across financial markets. As a result of the persistent high levels of inflation during 2022, the major central banks began tightening monetary policy last year and there were clear indications at the end of 2022 that the rate hiking cycle will continue for a good part of 2023.

Interest rates in the US, the UK and across the eurozone jumped to multi-year highs. Following the unprecedented low levels of interest rates for several years, this current rate hiking cycle is the steepest increase in rates ever registered by the major central banks. For example, the European Central Bank’s (ECB) deposit facility was stuck at minus 0.5 per cent until July 2022 and jumped to +2 percentage points by the end of last year. Given the continued elevated inflation rate, the ECB hiked rates at each meeting this year pushing up the deposit facility to a current level of 3.5 per cent. The President of the ECB and other officials of the central bank have recently been opining that further hikes in interest rates will take place imminently.

The impact of this rate hiking cycle is being reflected in different ways across the market. It is important to explain how the decisions by the central banks are filtering through the financial markets for the benefit of retail investors especially following the low interest rate environment that many became accustomed to over the past decade.

In the banking sector in Malta, the largest banks have not followed through with similar upward movements on their deposit rates. Meanwhile, it is evident that various other banks are actively marketing improved deposit rates of three per cent for one-year, two-year or three-year term deposits in order to try to attract some of the liquidity from the other banks that have not offered similar rates to their customers. There are various reasons for this differing strategy across locally-based banks. This is offering an opportunity to retail investors to consider mobilising part of their idle liquidity in favour of those institutions that offer superior returns.

Across the money market, the hikes by the ECB were quickly reflected in higher yields of Malta Government Treasury Bills. The yield in the recent auctions for three-month TBills jumped to just over 3.4 per cent which is very much in line with the deposit facility of the ECB. This is proving to be a popular avenue for retail and corporate investors to park idle liquidity held across the banking system.

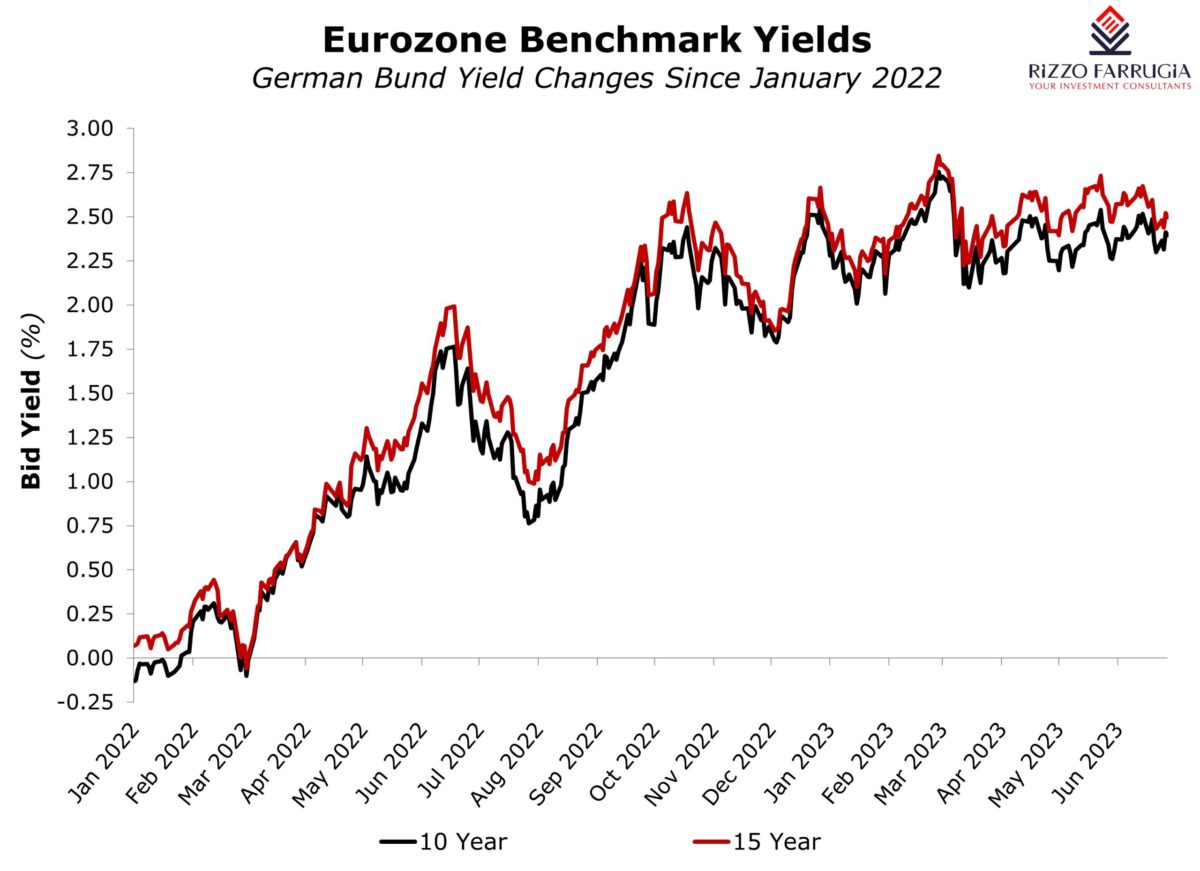

Meanwhile, the yields on longer-term bonds across Europe and Malta did not respond in the same manner. Following the sharp upturn in yields in the latter part of 2022, these have since remained trading in a relatively tight range despite the continued sharp increase in official interest rates by the ECB. The yield on the 10-year German bund, which is the benchmark for the eurozone, jumped from circa 1.3 per cent in July 2022 to above 2.4 per cent in October 2022 but then remained within a tight range since then despite hitting a high of just above 2.7 per cent in February 2023.

The daily pricing mechanism adopted by the Central Bank of Malta in its role as a ‘market maker’ for Malta Government Stocks reflects movements in yields across the eurozone. While this is the reference price used for trades in the secondary market, in turn, it also affects the pricing for new Malta Government Stocks.

In fact, last week the Treasury announced new MGS issuance of a maximum of €400 million across three different securities – one maturing in 2026, another in 2033 and another in 2038. Retail investors (up to a maximum of just under €500,000) have the option of applying in two issues, namely the three-year bond and the 15-year bond. Although the fixed prices will only be announced this afternoon, these would normally reflect the yields across the secondary market of circa 3.6 per cent for the 2026 bond and juts below four per cent for the 2038 bond.

It should therefore not be a surprise if the four per cent MGS 2038 would be priced at 100 per cent (par). In this eventuality, it would be the third time in succession that retail investors would have had the option of acquiring new MGS at a four per cent yield. However, while this yield was for a 10-year bond in October 2022, it is now being offered for a 15-year bond while in February 2023, this yield was available for a 20-year bond. This is reflective of the flat shape of the yield curve across the Maltese and eurozone bond markets.

Following the offer period over the coming days, it would be interesting to analyse the response by the investing public to the recent issues. It is worth recalling that rather surprisingly, in the last MGS issue in February, there was almost identical demand by the public to the five-year and 20-year bond. In fact, total subscriptions amounted to €87.9 million in the 3.5 per cent MGS 2028 and €91.3 million in the four per cent MGS 2043. Some investors may have thought that yields for longer-term bonds would increase in view of the clear path of rate hikes by the ECB. Since yields on longer-term bonds have not increased over recent months, it would be interesting to see whether the large majority of retail investors would now be willing to fix their yield for 15 years.

In fact, most international economists currently do not expect the yield on the 10-year German bund to be above the current level of 2.4 per cent over the next 12 months despite the continued sticky levels of inflation and further planned rate hikes by the ECB. Late last year, I had written an article titled Have bond yields peaked?. This may have surprised many readers in view of the clear path of interest rate hikes that were being predicted by the major central banks at the time. Although these rate hikes materialised, the yields on sovereign bonds across the eurozone were not particularly impacted. This is a major factor for investors to consider in the upcoming MGS issuance.

Read more of Mr Rizzo’s insights at Rizzo Farrugia (Stockbrokers)

The article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article.

Pioneering the 5th freedom: Enhancing research, innovation, and education in the single market and Malta’s role

Malta stands to gain significantly from the establishment of the 5th Freedom

Beyond numbers: Understanding the significance of pricing multiples for informed investing

Market participants may calculate financial metrics to take investment decisions following the end of the reporting season

Reinventing the single market: Strategic vision and bold reforms for Malta and Europe

Proposed reforms present significant opportunities and formidable challenges for our small island nation