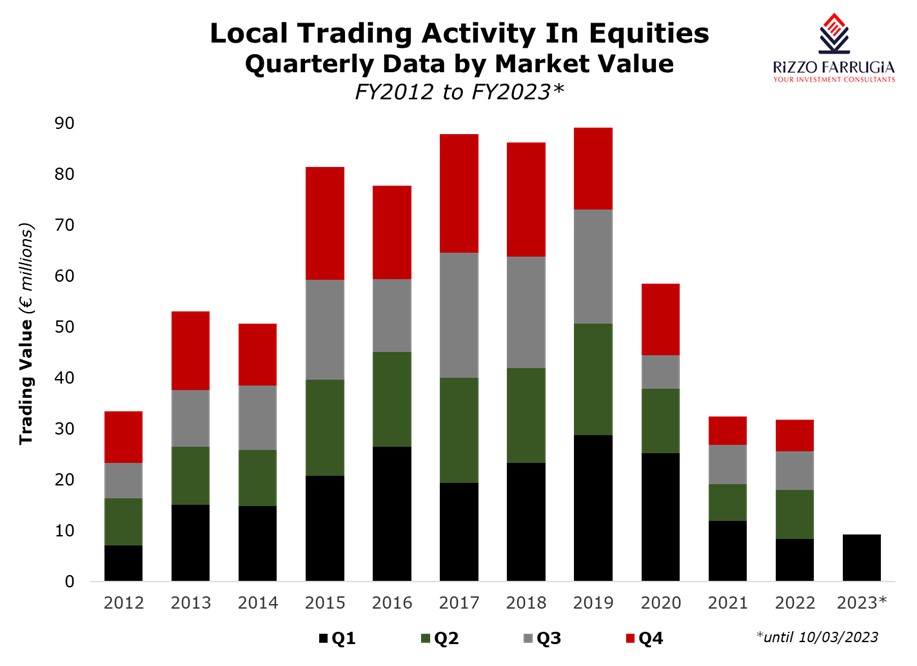

At the start of the year when reviewing the performances of various asset classes in 2022, I remarked that the Maltese equity market had suffered its third consecutive year of decline. I had also explained that ever since the outbreak of the COVID-19 pandemic exactly three years ago, investor sentiment remained particularly weak as evidenced by the sharp decline in trading activity across the equity market. In fact, overall trading activity across the equity market in 2022 of just €31.9 million was at its lowest level in 13 years and represents a decline of 64 per cent from the pre-pandemic high of €89.2 million in 2019.

The weakness across the Maltese equity market came about as a result of the severe headwinds that happened within a short period of time namely the political crisis in November 2019 followed by the COVID-19 pandemic in early 2020, Malta’s FATF greylisting between June 2021 and June 2022 and the impact of the Ukraine war at the start of 2022. I had also opined that the Maltese equity market is indeed facing a ‘crisis of confidence’.

It is reassuring to note that trading volumes have started to recover with a total value of €9.3 million during the first 10 weeks of 2023. While this is still well below the normal trading volumes experienced prior to the pandemic, the trading activity so far this year is recovering consistently from the very weak levels that characterised most of the last three years. In fact, should this momentum be maintained during the next three weeks, the activity in the first quarter of 2023 would be equivalent to the activity seen in Q4 2020 and Q1 2021 when volumes had improved as a result of the positive outcome of the approvals of a number of COVID-19 vaccines.

The gradual recovery in trading volumes across the equity market over recent weeks could be attributed to the improved outlook for a number of companies as a result of the change in the interest rate environment as well as the upturn across the Maltese economy spearheaded by the stronger-than-expected recovery in the tourism sector during the second half of 2022. The positive momentum across the sector is evident from the improvement in passenger volumes being reported by Malta International Airport plc on a monthly basis.

Indeed, the equity of MIA ranks as the second most-actively traded since the start of the year with €1.6 million worth of shares having changed hands. Apart from the stronger-than-expected recovery in passenger volumes last year and the positive outlook for 2023, the resumption of dividends to shareholders after three years is surely a major determining factor behind the higher trading volumes.

As explained in a number of my recent articles, the change in the interest rate environment over recent months with the European Central Bank pushing their deposit facility to the highest level since 2008 is an important determinant of the near-term outlook for the banking sector. In view of the expected upturn in profitability across the banks, it is not surprising that the increased volumes across two of the banking equities is the main contributor to the higher levels of trading activity across the equity market. Elsewhere, it remains disappointing that companies in other sectors continue to trade very infrequently.

The most actively traded equity during the past 10 weeks was Bank of Valletta plc with a total value of €2.85 million accounting for 31 per cent of the total equity market volumes. Meanwhile, a total value of €1.5 million worth of HSBC Bank Malta plc shares changed hands since the start of the year.

The banking sector is once again grabbing the international headlines following the collapse of Silicon Valley Bank and Signature Bank over recent days and the measures taken by the US Government and the Federal Reserve to takeover both institutions and backstop all depositors. Despite these emergency measures, the shares of US and also European banks continued to decline at the start of the week.

Although it is important to continue to monitor the evolving situation across the US banking sector, it is worth highlighting that the business models of these US regional banks that ceased to operate are totally different to the Maltese retail banks and most of the larger eurozone banks. Incidentally, last Monday morning during an online event organised by APS Bank plc, the chief economist of the Central Bank of Malta, Aaron G. Grech, delivered a presentation regarding inflation and interest rates and remarked about the strength of the Maltese financial system. Dr Grech explained that Maltese banks remain very well-funded and are ‘incredibly liquid’ which is very reassuring when compared to the remarkable developments taking place in the US.

The recent developments in the US also impacted bond markets earlier this week with yields initially tumbling (bond prices rising) as many economists now do not expect the Federal Reserve to aggressively hike interest rates again on 22nd March. Despite the decline in yields earlier this week, the overall sharp upward trajectory in yields over the past 15 months has led to a notable mobilisation of idle liquidity in Malta from the banking system into the capital markets. Although a large proportion of Maltese investors will continue to favour fixed-income securities and the more attractive yields available including in money-market instruments may somewhat hinder the continued recovery in trading volumes across the equity market, the sheer amount of liquidity across the financial system also highlighted by the Central Bank’s chief economist should not be underestimated.

The resilience of the Maltese economy coupled with the confirmations of dividend distributions by most companies listed on the Malta Stock Exchange as well as the positive outlook for a number of the sectors in which the companies operate in, should continue to help investor sentiment improve. This is likely to lead to further flows into the equity market contributing to a consistent improvement in trading volumes already evident in recent weeks.

Read more of Mr Rizzo’s insights at Rizzo Farrugia (Stockbrokers)

The article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article.

Reduction in free float

Lowering Malta’s minimum free float requirement to 10% could unlock new opportunities for the local capital market

A golden age for GO plc

GO plc’s Annual General Meeting revealed a bold shift beyond traditional telecoms, stronger-than-ever financials, and possible share buy-backs

Another v-shaped recovery

Towards the end of 2024, most investment banks predicted that the S&P 500 index would continue its positive streak