China’s economy is going through a difficult transition as Beijing tries to overcome the crisis caused by the COVID-19 pandemic and huge debts in the real estate sector. In 2023, newly started residential buildings are half the surface they were back in 2020. China’s new home sales dropped 6% in 2023, with second-hand home prices declining in major cities.

To rebrand the local economy, China is now investing heavily in what president Xi Jinping calls the “three new industries” – photovoltaic cells, electric cars, and lithium-ion batteries. The rest of the world should be preparing for the next phase of the “made in China” economic shock.

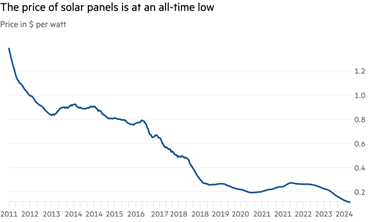

In the solar panel industry in particular, China is producing so much that the global market has been flooded with these products and their prices have crashed. Solar panels have become so cheap that they are being used to build garden fences in the Netherlands and Germany, as a boom in Chinese production saturates the global market. The panels capture less sunlight when used as fencing than they do on roofs, but the process saves on high labour and scaffolding costs, according to analysts and posts on social media by households that have installed them.

At the beginning of the year, we found out that Chinese maker Build Your Dreams (BYD) had a better 4th quarter than Tesla, becoming the largest electric vehicle maker in the world.

In the period between the late 1990s and early 2000s, the global economy went through a trade shock caused by China, when an explosion of cheap Chinese imports helped to keep inflation down, but led to the loss of many jobs in local production. Now, the second coming of this shock could follow. China’s factories produce more cars, machinery, and consumer electronics than the domestic market can absorb.

Taking advantage of favourable loans from the state, Chinese companies crowd foreign markets with products they cannot sell at home. In the 2000s, overproduction came primarily from China, while factories in other parts of the world were closing. Now the US and EU are investing heavily and protecting their industries as geopolitical tensions continue to rise. The US, Europe and Japan do not want a repeat of China’s first shock and are propping up industries deemed strategic with billions of dollars while imposing or threatening to impose tariffs on Chinese imports. The first shock came after a series of liberal reforms adopted by China in the 1990s and its accession to the World Trade Organization in 2001. Those who benefited most from falling prices were low- and middle-income earners.

At the same time, the shock in China puts a lot of pressure on local manufacturers. In 2016, economists estimated that the U.S. lost more than 2 million jobs between 1999 and 2011 to Chinese imports, as furniture, toy and clothing manufacturers succumbed to competition, and workers in the hardest-hit communities had difficulty finding other jobs. Unlike Japan or South Korea, which have abandoned low-cost manufacturing in favour of higher-value exports, China has retained its dominant position in low-cost sectors even as it increasingly penetrates the product category normally dominated by advanced economies. In contrast to the situation in the 2000s, the West now regards China as its main economic rival and geopolitical adversary. The EU is set to decide whether China’s electric cars are unfairly subsidized and whether tariffs or other import restrictions should be imposed, while candidate Donald Trump has proposed tariffs of 60% or higher on Chinese imports, if he becomes president this coming November.

Reduction in free float

Lowering Malta’s minimum free float requirement to 10% could unlock new opportunities for the local capital market

A golden age for GO plc

GO plc’s Annual General Meeting revealed a bold shift beyond traditional telecoms, stronger-than-ever financials, and possible share buy-backs

Another v-shaped recovery

Towards the end of 2024, most investment banks predicted that the S&P 500 index would continue its positive streak