On 1st June 2023, the National Statistics Office (NSO) published a press release providing some important information on the dynamics of the debt held by the Government of Malta.

The data provided and the key trends emerging on the structure of Malta’s debt is important information for the various types of investors (retail, corporate and institutions) who participate in the debt market. Similar to the analysis that an investor ought to conduct on the financial soundness of a company, one should also have a good knowledge on the state of a country’s finances when providing finance to the Maltese Government via Malta Government Stocks or Treasury Bills.

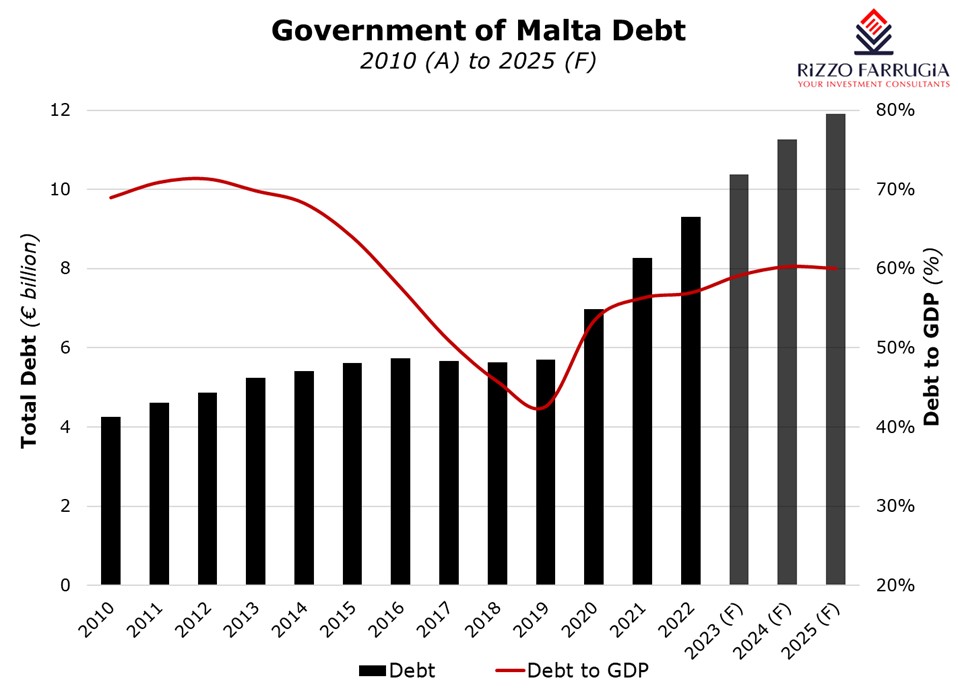

The NSO confirmed that at the end of 2022, the overall government debt exceeded a level of €9.0 billion representing an increase of €739.5 million over 2021. Over the past three years, the debt level increased by no less than €3.3 billion from a level of €5.7 billion at the end of 2019 before the pandemic to over €9.0 billion at the end of last year. This data depicts the severe impact on the Government’s finances from the two major shocks over recent years, namely the COVID-19 pandemic and the war in Ukraine. These extraordinary events that occurred in quick succession had similar repercussions across most global economies.

Similar to other governments internationally, the Government of Malta supported a number of industries during the course of the pandemic. Moreover, since last year the Government of Malta also subsidised energy prices following the crisis arising from the war in Ukraine which is estimated to amount to an outlay of circa €600 million for 2023 alone.

While it is important to gauge the absolute level of debt as well as the movements over a specific number of years, one should also compare the debt level to the country’s GDP. In fact, a very common metric used by most credit rating agencies is the debt to GDP ratio. In Malta’s case, the debt of over €9 billion as at the end of 2022 is equivalent to 53.4 per cent of GDP. In view of the very sharp increase in the debt levels over the past three years, the debt to GDP has also been on an increasing trend as this rose from the level of 43 per cent in 2019 prior to the pandemic. Despite the evident deterioration in this important metric, it is fair to say that Malta’s debt to GDP ratio remains at a comforting level when compared to many countries in the EU and several large economies worldwide.

The government debt to GDP ratio across the European Union as at the end of 2022 was of 84 per cent with the most-indebted countries being Greece (171.3 per cent), Italy (144.4 per cent), Portugal (113.9 per cent), Spain (113.2 per cent), France (111.6 per cent) and Belgium (105.1 per cent).

Meanwhile, the elevated levels of debt are also evident in some of the largest global economies. Over recent weeks, the international headlines were dominated by negotiations on the debt ceiling of the US government. Few investors may be aware that that the overall level of debt amounts to over USD32 trillion which is equivalent to circa 116 per cent of GDP.

In the press release earlier this month, the NSO also published statistics on the categories of holders of the Government’s debt. The majority of debt remains in the hands of local financial corporations, namely commercial banks and insurance companies. As at the end of 2022, this category held 60.4 per cent of overall debt which is only marginally higher than the level pre-pandemic.

Meanwhile, there was an evident decline in the percentage held by ‘retail investors’ as this decreased to 15.7 per cent in 2022 from 23.5 per cent in 2019. On the other hand, the ‘rest of the world’ category, comprising international financial institutions, increased its share of the debt level to 22 per cent in 2022 from 15.2 per cent in 2019. This implies that this category was hugely supportive during the period from 2020-2022 by acquiring a good portion of the sizeable amounts of new MGS on offer in order to fund the fiscal stimulus.

The silver lining of the historically low interest rate environment that dominated the last decade was the ability of the Government of Malta to fund the extraordinary level of subsidies over recent years at very low rates of interest. In fact, the cost of debt on the entire level of outstanding debt dropped to only 1.9 per cent in 2022 from a level of 3.8 per cent in 2016 and 3.3 per cent in 2019. On the other hand, however, following the surge in interest rates over the past few months, this trend will start reversing itself with the Government surely needing to offer higher rates of interest to finance the deficit and the debt being redeemed. This was evident in the jump in yields across the Treasury Bill market to over 3.5 per cent as well as the coupon of four per cent in the MGS issues in October 2022 and February 2023.

With over €1 billion in new funding required annually for this year and also in each of the next two years, the Government will be negatively impacted from the higher debt servicing requirements in future years which in turn will effectively place added pressure on annual budgetary requirements.

While the debt to GDP ratio thankfully remains well below the EU average, the absolute level of Government debt at over €9 billion is projected to increase to almost €12 billion in 2025 according to the Budget Estimates published some months ago. This would imply that the overall level of debt would have doubled over a 6-year period. Measures to address the upward trajectory of the Government debt need to be taken in the interest of the entire Maltese population since this can greatly condition social measures available to future generations. Constituted bodies need to lead a national debate on the requirement for the Government to carry out a cost rationalisation exercise on the one hand and improved tax collection measures on the other hand.

Read more of Mr Rizzo’s insights at Rizzo Farrugia (Stockbrokers)

The article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article.

Pioneering the 5th freedom: Enhancing research, innovation, and education in the single market and Malta’s role

Malta stands to gain significantly from the establishment of the 5th Freedom

Beyond numbers: Understanding the significance of pricing multiples for informed investing

Market participants may calculate financial metrics to take investment decisions following the end of the reporting season

Reinventing the single market: Strategic vision and bold reforms for Malta and Europe

Proposed reforms present significant opportunities and formidable challenges for our small island nation