Malta attracts big business with one of the most advantageous tax systems in the world. A prime example is how the world’s largest meat processor, utilises the island to avoid hundreds of millions in taxes.

The company in question is JBS SA group (JBS). Based in Brazil, it is the world’s largest meat processor, operating in 20 countries and selling its products in over 100 countries. Its brands include Pilgrim’s Pride, Swift, Moy Park and Seara.

The company earns approximately 51 per cent of its annual $77.2 billion in net revenue within the United States. Currently, JBS has the capacity to slaughter a staggering 9 million lambs, 27 million cows, 53 million pigs and 5 billion chickens per year.

In addition to its extensive history of illegalities and environmental destruction which includes child labour, artificially curbing supply and bribes, JBS has devoted significant effort to creating a complex web of subsidiary companies designed to limit its tax exposure.

Intertwined with other tax avoidance mechanisms, it shifts taxable profit away from jurisdictions like the US, UK, Canada, Mexico, Brazil and Australia toward low-tax or no-tax jurisdictions that includes Luxembourg and Malta.

A 2024 study by SOMO, the Netherlands-based Centre for Research on Multinational Corporations, exposed a web of JBS-owned Luxembourg-based subsidiary companies that is estimated by SOMO to have allowed JBS to avoid paying between $221 million and $442 million in taxes to jurisdictions including the US, UK, Canada, Brazil, Australia and Mexico between 2019 and 2022 (2022 being the most recently available Luxembourg financial records at the time of the study).

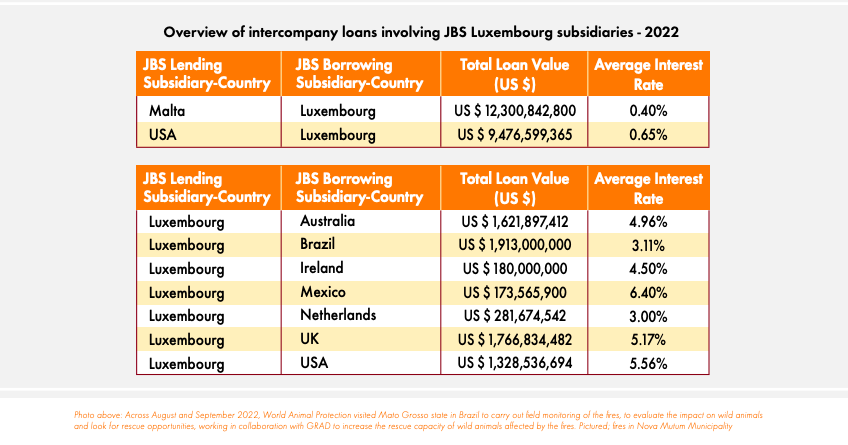

JBS entities registered in the US (Delaware) and Malta have provided JBS’ Luxembourg subsidiary companies with billions of dollars in capital, through loans with limited (or in a number of cases zero) interest rates.

These Luxembourg-based JBS subsidiary companies then provide loans to JBS entities in key operating markets like the US, UK, Ireland, Australia, Brazil and Mexico at much higher interest rates. The differential between those interest rates was then captured as profit within the Luxembourg entities.

The JBS entities in these key operating markets subsequently paid substantial amounts of interest on the loans. For the period 2019-2022, SOMO traced between $1.5 billion and $2.2 billion in annual inter-company interest payments collected by the JBS entities in Luxembourg.

Malta as a JBS-lending subsidiary company loaned its Luxembourg counterparts around $12 billion with a low average interest rate of 0.4 per cent. This is then loaned from Luxembourg subsidiaries to countries like Australia, Brazil and Ireland for higher interest rates.

SOMO detected annual interest payments totalling almost $200 million, paid by JBS USA Food Company (Delaware) to JBS USA Lux S.A. (Luxembourg). The interest payments are accounted for as a cost for tax purposes on the payer side (in the US), and as income on the side of the receiver (Luxembourg). Through these interest payments, profits are thus shifted from JBS’ key operational markets, including the US, to Luxembourg. JBS entities in Luxembourg effectively pay close to zero in corporate income taxes, thereby making this tax avoidance scheme very lucrative for the JBS group.

World Animal Protection, an advocacy group based in the US, said in a report that it was “greatly concerned” that JBS has been able to partly fund the global expansion of its factory farming operations by avoiding the payment of tax to some of its most profitable countries of operation.

To avoid paying taxes on these offshore corporate profits, some companies like JBS simply leave them abroad indefinitely, but others use accounting gimmicks to move the profits around so that they appear to be earned in countries with lower tax rates than the US, even though they remain untaxed in those countries too.

The most common way this happens is by having subsidiaries in low-tax jurisdictions borrow money from their parent companies in higher-tax jurisdictions at artificially high-interest rates (so-called “high margin loans”) so that interest payments can be deducted from taxable income even though no real cash flows out of the company.

The result is that huge companies end up paying little or no taxes on profits generated abroad – even if those profits represent an important source of revenue for them.

“In circumstances where JBS has recently received permission to list its shares on the New York Stock Exchange, it is timely to shine a light on JBS’ status as a poor corporate tax citizen in the US and its other major operating markets,” the lobby group said.

At the start of 2014, the JBS global corporate group featured just one subsidiary company registered in Luxembourg. By the end of 2015, that number had grown to 16 Luxembourg registered subsidiary companies. By 2022, JBS controlled 17 separate subsidiary companies registered in Luxembourg.

Call for trade mission for Malta-based businesses to Wales and Liverpool

Interested parties are invited to e-mail TradeMalta by not later than Tuesday 17th March

Malta sets birth rate growth targets after years of decline

Vision 2050 envisages gradually increasing birth rate from 1.01 to 1.3 by 2035

Wolt Market unveils refreshed identity in Malta

Expanded partnerships with Maltese producers, upgraded fresh food categories, all in vibrant green – Wolt Market marks a new milestone