Earlier this week MedservRegis plc published a prospectus in connection with a €25 million bond issue which included an updated financial analysis summary containing revised financial forecasts for 2025 and projections for 2026.

At a time of significant media attention being given to the corporate bond market and following the very weak financial performance of MedservRegis for a large part of the past decade, a detailed look at the Group’s recent financial performance and near-term expectations are very important for bondholders and also shareholders who endured a torrid time over the years with no dividend distributions between 2016 and 2023.

The financial performance of the MedservRegis Group has been particularly encouraging since 2023 with increased revenues from the Integrated Logistics Support Services (ILSS) segment. The Group returned to profitability in 2023 and registered a more meaningful profit in 2024. Moreover, the financial results for the first half of 2025 showed a continued strong upturn following the long-anticipated commencement of contracts for oil and gas companies in certain key regions most notably in Malta (for works offshore Libya) and Cyprus.

Dividends resumed recently with a total of €2.5 million distributed to shareholders with respect to the 2024 financial year and earlier this month, the company declared a €1 million dividend payable on 29th October 2025.

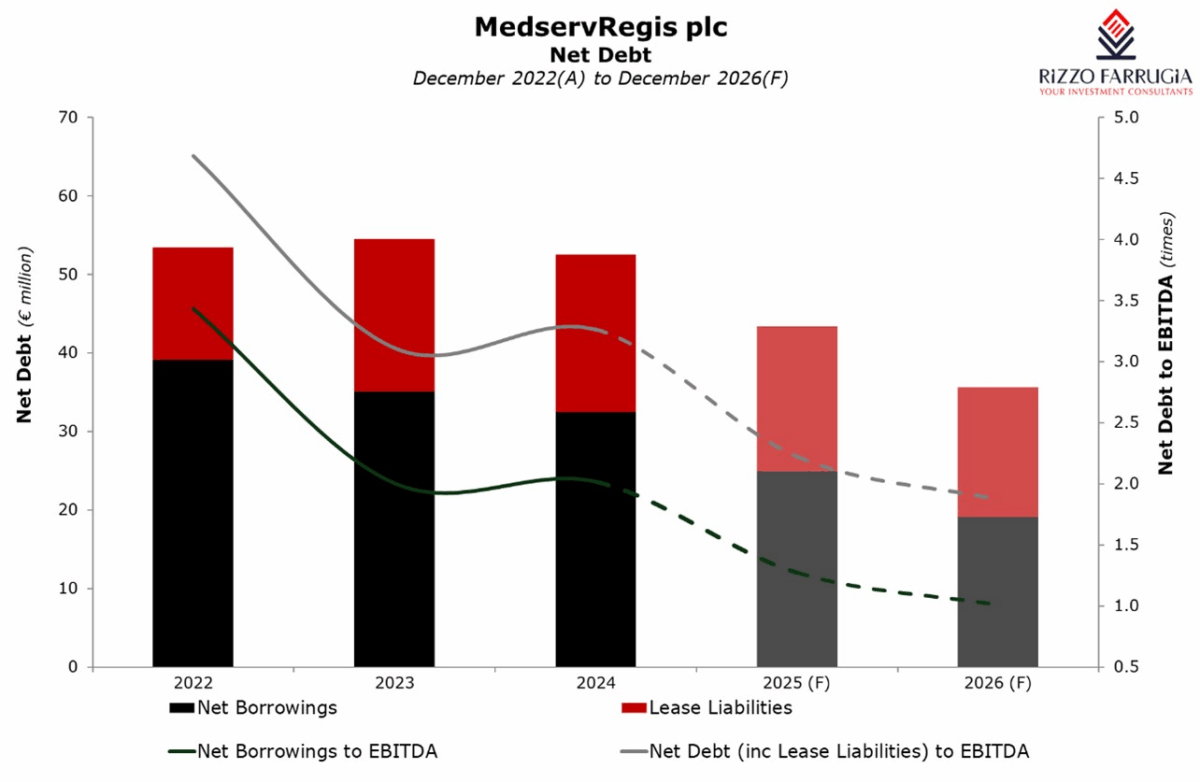

MedservRegis has also been reducing its high level of borrowings in recent years as its financial performance and cash flow improved accordingly. The current bond exchange offer amounts to €25 million and is primarily targeted to the holders of the €30 million bonds due to mature in 2026. Apart from this planned reduction of €5 million in bonds, MedservRegis is expecting its cash position to improve in the coming months from a forecasted level of €18.6 million at the end of 2025 to over €23 million at the end of 2026. Net debt is anticipated to drop to €35 million by the end of 2026 which includes lease liabilities of €16.5 million. Coupled with the projected upturn in EBITDA to €19 million in 2025 and also in 2026, the net debt to EBITDA ratio is anticipated to decline to a very healthy level of just below 2 times. Likewise, the interest coverage ratio is anticipated to improve to above 5 times in 2025 and expected to remain at this elevated level also next year in another sign of the sustainable level of debt of the MedservRegis Group.

The lease liabilities relate to the recognition of the leases of the Group’s bases located across the various locations where it operates from. This is an important consideration when analysing the financial statements of MedserRegis. In fact, the income statement continues to show a high level of depreciation at over €8 million annually. This mainly relates to the Right of Use assets, which currently amounts to just over €50 million.

While this elevated depreciation on the right of use assets reduces the reported profit for the year, an analysis of the cash flow statement is more important in this case as it eliminates non-cash adjustments and reveals a more realistic liquidity position of the Group which is fundamental for shareholders and also for bondholders. Ultimately, cash is what is required for companies to settle interest on bonds, pay suppliers and distribute dividend to shareholders.

MedservRegis expects to have available cash of just over €23 million by the end of 2026 which it can use for its growing level of operations in various parts of the world, ongoing dividend payments to shareholders and also to reduce further its overall debt.

Excluding lease liabilities, borrowings are projected to amount to a total of €42.3 million by the end of 2026 comprising €4.8 million in bank debt and the balance in the form of two bonds – €13 million due in December 2029 (this was reduced from €20 million at the time of refinancing in 2022) and the new €25 million bonds due between 2031 and 2036.

In view of the project-based nature of work, the financial performance of the Group had been erratic over the years coinciding with the timing of projects and oil exploration activity in various regions. However, the future financial performance of the Group should translate into consistent levels of profitability also in 2027 and beyond. The nature of the current contracts in hand and the upcoming business pipeline provides strong visibility on the future financial performance of the Group beyond 2026. These major projects include a 30-well drilling campaign for works offshore Libya which is currently being serviced out of the Malta base and the recent four-year contract award in Suriname which is expected to commence towards the second half of 2026. Moreover, the major oil companies operating from Cyprus are moving from exploration activities to the development phase which entails longer-term timelines as opposed to exploration projects.

In some of the recent media articles debating the state of the Maltese corporate bond market, there was repeated mention of the need to introduce the requirement by issuers to have a sinking fund to enable them to repay their bonds upon maturity. I do not agree with the concept being eluded to by these opinion writers that companies should always aim to eliminate any form of debt via the requirement of sinking funds. Debt forms an integral part of long-term financial planning by companies. This can also be seen in the financial position of MedservRegis.

With €23 million in cash projected by the end of 2026 and assuming the recent financial performance can at least be sustained (if not improved) in future years given their recent contracts, the company could be in a position to easily repay its €13 million bond repayment due in late 2029. This will thereafter result in a materially lower level of leverage which is very sustainable in the medium to long-term given the upturn in profitability levels and the healthy financial strength of the Group in what can be termed a successful turnaround from the very challenging situation until 2022.

Rizzo, Farrugia & Co. (Stockbrokers) Limited is acting as Sponsor, Manager & Registrar to MedservRegis plc

The article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article.

Featured Image:

Medserv / mmf.org.mt

Revisiting the idea of privatising the Malta Stock Exchange

The involvement of international institutional investors is likely to result in a more liquid secondary market, notes Edward Rizzo

Further growth ahead for MIA

2025 was another record year for MIA, and 2026 will have the same fate

Observations from the equity market

Malta’s equity market remains subdued