My article last week documented the strong upward movement of the S&P 500 index in the US and based on the data of previous bull markets, there is clear evidence that this upward trend should persist in the short-term albeit as always, there are various risks which could alter the course of the new bull market.

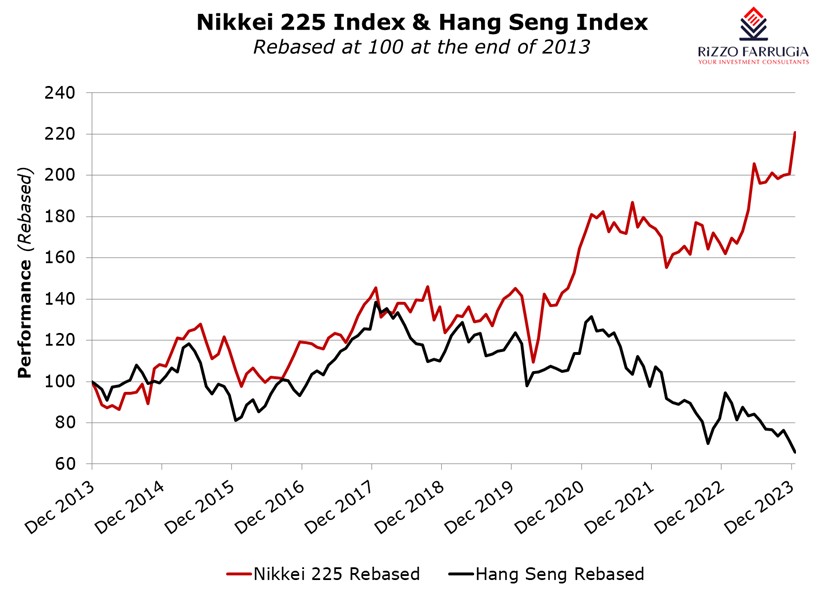

European equity markets have also been performing particularly well following the sharp downturn in 2022. Meanwhile, across Asia, the situation is somewhat different with the Japanese equity market also experiencing a notable rally while the Chinese equity market has been underperforming in a material manner for several years largely due to concerns about the property sector and weaker consumer sentiment.

In my articles over recent years, I regularly tackled developments across the US and European markets since these are the ones which Maltese investors would be mainly exposed to. However, given the mixed fortunes in Japan and China amid recent notable events, it would be worth providing key highlights about these two important financial markets on a global scale.

Over the past couple of years, Japanese equities performed particularly strongly following a protracted period of underperformances. Japan experienced a prolonged economic downturn following its property market collapse in 1990. There are various indices that track the Japanese equity market with the most-commonly used across the international financial media being the Nikkei 225 index. Since the Nikkei 225 index is price-weighted (similar to the Dow Jones Industrial Average index), its performance might differ from other indices weighted by market capitalisation such as the MSCI Japan Index or the TOPIX Index.

The all-time high for the Nikkei 225 index was on the last trading day of 1989 (29 December) with a reading of 38,915 points. In the 1980’s, the Japanese equity market had been surging as a result of rapid economic growth which unfortunately had led to a speculative bubble across various asset classes. The Nikkei 225 index dropped by 39 per cent in 1990 and entered into a prolonged bear market hitting a low of just 7,054.98 points in March 2009. Over a 20-year period, the market had fallen by an extraordinary 82 per cent.

With a growing belief that Japan is overcoming its long-standing battle with deflation, the Japanese equity market started its long-awaited recovery just over 10 years ago. The Nikkei 225 index posted positive performances every year since 2012 (with the exception of 2018 and 2022). Last year, the Nikkei 225 surged by 28.2 per cent (its largest one-year gain since 2013) and continued to perform particularly well during the start of 2024. The performance of the Japanese market has been hitting international media headlines since the various indices tracking the equity market are hitting their highest levels since 1990. Essentially, the current index reading of just over 36,000 points implies that the market is circa 7.5 per cent from its all-time high reached 24 years’ ago.

The Nikkei 225 Index is currently dominated by the technology sector which constitutes nearly 50 per cent of its weighting, with the largest companies within this sector being semiconductor firms Tokyo Electron and Advantest Corporation. Interestingly, the Nikkei has a broad classification of technology stocks, which also include automobile companies (Toyota, Nissan, Honda), pharmaceutical companies, and communication companies. These latter industries would typically fall within other sectoral classifications across other benchmark indices across the world. The largest company within the Nikkei 225 accounting for just over 10 per cent of the index is Fast Retailing Co. Ltd., a consumer goods company operating a number of large fashion retail brand subsidiaries.

Although Japan seems to be overcoming its decades-long struggle with deflation, one notable factor behind the recent outperformance of Japanese equities was the loose monetary policy as the Bank of Japan held its interest rate at a negative 0.1 per cent since 2016. Moreover, there are other factors that surely helped revive the Japanese equity market. The new rules adopted by the Tokyo stock exchange, which encourage companies to improve their market valuations and shareholder returns apart from refining their corporate governance structures, surely provided a positive influence to investor sentiment.

Moreover, the sizeable investments by Warren Buffett’s Berkshire Hathaway in the five largest Japanese general trading companies (Itochu, Marubeni, Mitsubishi Corp., Mitsui & Co. and Sumitomo Corp.), have been seen as a strong vote of confidence in the Japanese market and attracted a lot of international media attention.

In contrast to the excellent performance of Japanese equities, the Chinese equity market had yet another negative performance in 2023. The two most popular indices that are used to track the Chinese equity market are the Hang Seng index and the Shanghai Composite index. The Hang Seng index includes the shares of many large Chinese companies that are listed in Hong Kong. The Hang Seng index dropped by almost 14 per cent in 2023, marking the first-ever 4-year losing streak since its launch in 1969.

Chinese equities have lost over USD6 trillion in market value since their peak in 2021. This underperformance highlights the distinct challenges faced by the Chinese market including a disappointing rebound in post-pandemic spending. The Chinese stock market has been impacted by regulatory crackdowns on technology and payment companies as well as the alarming property market crises with the most recent bankruptcy of the major property developer Evergrande.

The drastic changes to China’s regulatory regime with one of the aims being to curb spending on online games affected the performance of a number of sizable Chinese companies. In particular, the largest Chinese company – Tencent Holdings – which was the seventh largest company in the world in 2021 with a market cap exceeding USD750 billion, lost more than half its market value, which slid below USD350 billion. Another large technology conglomerate – Alibaba – faired even worse. Alibaba was once one of the ten largest companies in the world until 2021 and now does not feature in the top 50.

Chinese authorities have been announcing various measures to stabilize the stock market, including limits on short-selling and purchases of bank shares by a government investment fund. This demonstrates the government’s urgency to protect retail investors and restore confidence in the market. These measures, including the latest announcement allowing banks to hold a lower amount of cash reserves, have so far failed to halt China’s stock market slide which hit a fresh 5-year low this week.

Investors who have exposure to these major capital markets across Asia either directly or indirectly via a number of exchanged traded funds need to keep constantly abreast of ongoing developments especially regulatory changes that can severely impact overall returns.

Read more of Mr Rizzo’s insights at Rizzo Farrugia (Stockbrokers).

The article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article.

Mobilising savings into investments

Malta’s equity market needs to grow in size and depth if it is to embrace the EU’s Savings and Investments ...

Reduction in free float

Lowering Malta’s minimum free float requirement to 10% could unlock new opportunities for the local capital market

A golden age for GO plc

GO plc’s Annual General Meeting revealed a bold shift beyond traditional telecoms, stronger-than-ever financials, and possible share buy-backs