In October 2022 I had published an article explaining the concept of the Treasury Bill market with specific reference to the surge in issuance in view of the sudden rise in interest rates which made these securities more appealing to the investing public most especially for companies in their treasury management activities.

Treasury Bills, or T-Bills, are short-term financial instruments issued by Governments worldwide with maturities of up to one year. T-Bills are referred to as ‘zero-coupon’ bonds. Maturities can be for one month, three months, six months, nine months or one year although the three-month and six-month T-bills are the ones most commonly issued.

In Malta, T-Bills are issued every week through a competitive bidding process (auction). The auction is typically held every Tuesday and the Treasury publishes a calendar every month giving advance notice of the issuance on a weekly basis.

Treasury Bills are issued at a discount and are redeemed at face value. The difference between the purchase price and the par value is the interest earned for holding the T-Bill for a specific period of time.

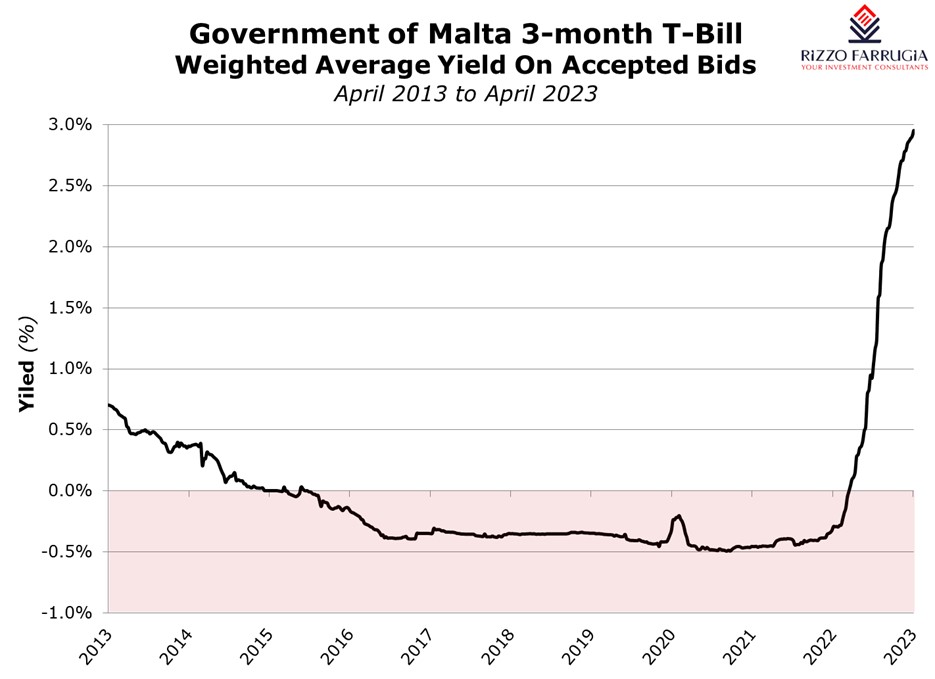

In line with the upward movements in yields worldwide, the Malta Government Treasury Bills also experienced a sharp upswing in yields over recent months.

An analysis of the tenders across the T-Bill market indicates that the weighted average yield of the three-month T-Bill has jumped towards the three per cent level in recent weeks compared to negative yields until June 2022 and a yield of below one per cent until the first week of October 2022. The three-month T-bill was producing a negative yield from May 2015 to June 2022 before surging in the past nine months in line with the three-month Euribor which is an important benchmark since it is the interest rate at which a selection of European banks lend funds to one another.

A similar pattern occurred in the yield of the six-month T-Bill. The weighted average yield of the six-month T-Bill increased to the three per cent level in recent weeks compared to negative yields until June 2022 and a yield of below one per cent until the end of August 2022. The six-month T-bill was producing a negative yield from November 2015 to June 2022.

However, it is worth noting some interesting movements in yields during the past two auctions. Last week, the cut-off rate of accepted tenders in the three-month T-Bill at 2.95 per cent was marginally above the cut-off rate of accepted tenders in the 6-month T-Bill at 2.947 per cent. On a weighted average basis, however, the yield on the three-month T-Bill of the accepted bids was 2.905 per cent which was minimally below the 2.91 per cent of the six-month T-Bill.

Meanwhile during this week’s auction, the cut-off rate of accepted tenders in the three-month T-Bill surpassed the three per cent level for the first time in a long number of years. Moreover, this exceeded the yield of the cut-off rate of accepted tenders in the six-month T-Bill at 2.95 per cent. On a weighted average basis, the yield on the three-month T-Bill of the accepted bids this week was 2.953 per cent which is above the 2.944 per cent of the six-month T-Bill.

In view of the significant upward movement in yields, there is an evident mobilisation of liquidity which was lying idle in the banking system into other instruments offering superior returns across the financial markets.

Although this was reflected in the steady demand across the local corporate bond market over the past several years, this became more evident over recent months especially when the Treasury issued 10-year Malta Government Stocks in October 2022 at a rate of four per cent per annum. Retail investors reacted very positively to this offering with just under €300 million taken up within a few days thereby crowding out the institutional auction. In the most recent MGS offering in February 2022, when the Treasury issued Malta Government Stocks once again at four per cent but for 20-years as opposed to 10-years, demand from retail investors remained strong as well. In fact, a total of €91.3 million was applied for by retail investors. More surprising however was the fact that the five-year bond at a yield of 3.24 per cent was equally in strong demand by retail investors with applications amounting to €87.9 million.

It is evident from recent trends that there is a clear change in attitude by retail and corporate investors following the sharp upturn in yields. This change in investor behaviour is also instigating a number of banks to widely promote fixed deposits once again. Regular media promotions are taking place to encourage retail and corporate customers to subscribe for two-year or three-year deposits at three per cent per annum.

However, investors need to compare the liquidity aspect of a fixed deposit when deliberating such an instrument as opposed to a T-Bill. Although Treasury Bills are normally held until their maturity date, holders of such securities have the facility of disposing of their holdings via the secondary market of the Malta Stock Exchange. The Central Bank of Malta (CBM), through the Government Securities Office, acts as ‘market-maker’ or ‘buyer of last resort’ for Malta Government Treasury Bills in the secondary market with prices quoted on a daily basis for those investors requiring to liquidate before maturity. This is one key advantage of a Treasury Bill as opposed to a fixed deposit at a bank.

The opportunity cost of holding excess liquidity lying idle without any return is now simply too large given the yield of three per cent for money-market instruments which are easily accessible to the investing public.

Read more of Mr Rizzo’s insights at Rizzo Farrugia (Stockbrokers)

The article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article.

Analysis: The functions of a capital market

Capital markets are essential for supporting innovation and long-term economic growth

Pioneering the 5th freedom: Enhancing research, innovation, and education in the single market and Malta’s role

Malta stands to gain significantly from the establishment of the 5th Freedom

Beyond numbers: Understanding the significance of pricing multiples for informed investing

Market participants may calculate financial metrics to take investment decisions following the end of the reporting season