For several years, Maltese constitutional courts and the European Court of Human Rights repeatedly decided that the protection granted to tenants of controlled leases were in breach of the owners’ right to enjoy their properties because of the forced relationship and the low rent received by the landlord.

These controls were initially introduced after the war period as a response to the damage incurred to the country’s housing stock, which led to a severe shortage of housing fit for habitation. Legislation at the time also allowed the government to requisition vacant privately owned dwellings and lease them to families in need of accommodation. Subsequent rent control legislations were introduced in the 1960s and 1970s.

In general, there are two types of controlled leases. The first refers to leases that started before 1st June 1995 and are protected under the Reletting of Urban Property (Regulation) Ordinance (Chapter 69 of the Laws of Malta). There are also leases that were derived from an emphyteusis or sub-emphyteusis, which are protected under the Housing (Decontrol) Ordinance (Chapter 158 of the Laws of Malta).

Since 2018, there were 2,714 court cases filed related to the old rent laws. Out of these, 1,343 cases were decided by the end of January 2024.

The stream of constitutional judgements sought to compensate the owners for suffering a violation of human rights, at times, however, putting at risk the tenants, many of whom were now elderly.

Therefore, in 2021, Government extended the mechanism applied for the controlled leases under Chapter 158, introduced in 2018, to apply for the pre-1995 leases regulated under Chapter 69. This meant that landlords could request the Rent Regulation Board to increase the rent charged to the tenant by up to two per cent of the open market value of the property, thus ensuring that the landlords receive a more appropriate rent. Despite the discretion granted to the Court, it can be noted that, in the vast majority of cases, the Court is opting to order a two per cent increase.

It is important to point out that most of these properties were rented unfurnished – compared to furnished properties in today’s private rental market – and, in general, tend to have a much higher need of repairs. In fact, statistics from the recently published Census indicate that between 15 per cent and 20 per cent of properties in the ‘rented unfurnished’ sector (mostly pre-1995 dwellings) require moderate or serious repairs or are in a dilapidated state, compared to only five per cent for properties that are owned or rented in the private rental market.

The two per cent threshold corresponds to broadly half the rental yield of four per cent to five per cent observed in the private rental market. With hindsight, this is also consistent with the decision by the European Court of Human Rights in Cauchi vs Malta, which adopted a formula to calculate the compensation for the violation of the right to enjoy one’s property as a result of controlled rents.

In this decision, the European Court of Human Rights recommended that from the estimate of the rental income of property at market prices, one deducts 30 per cent due to the public interest at the heart of the laws for controlled leases and a further 20 per cent due to the uncertainty of renting the premises throughout all these years. From this amount, the Court further deducts any rents that were effectively paid to the landlord.

This method is now also being adopted by the local Constitutional Courts. Indeed, an exercise carried out by the Housing Authority on a random sample of cases that were decided in 2023 and 2024 found that the ratio of the rent as increased by the Court to the median rent for a two-bedroom apartment amounted to around 50 per cent – which is in line with what one would expect given the ratio of two per cent to the market rental yield.

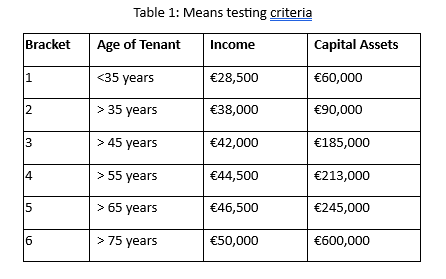

In the cases before the Rent Regulation Board, before the Board decides on the rent increase to be paid by the tenant, it performs a means test to verify whether the tenant can continue to occupy the property under a title of lease. The means test criteria include thresholds for income and assets for different age brackets (see Table 1). If the tenant exceeds the threshold limit of either the income or the capital assets, such tenant shall be deemed to have sufficient means to afford an accommodation in the current market and an eviction is subsequently ordered by the Board.

Following the judgement delivered by the Board, the Housing Authority has a scheme in place to assist the tenants with the payment of the increase in rent. In the case of elderly tenants, the Housing Authority pays the entire difference between the previous rent and the newly established one, up to a maximum of €10,000 per annum, while tenants continue to pay the same annual rate that they have always paid to their landlord. This is intended to provide them with peace of mind that while their rent will remain affordable, they will not be displaced from the place where they have spent most of if not their entire life. At the same time, the landlord receives a decent sum for renting the property, thus ensuring the right to enjoy one’s property is safeguarded.

The subsidy scheme is a stability measure introduced by the Government and delivered by the Housing Authority to provide the basic right to a roof over one’s head. Working tenants residing in these dwellings pay a maximum of 25 per cent of their income, with the rest, if any, being subsidised by the Housing Authority.

To date the Housing Authority has provided rental subsidies to 1,047 families on pre-1995 rents. In addition, the Authority provides other forms of assistance, such as the provision of free legal assistance and, where the rent due exceeds €10,000, the allocation of alternative accommodation. For instance, 400 families have benefitted from free legal assistance in 2023. The expenditure on pre-1995 rent subsidies rose from €1.75 million in 2022 to €4.86 million in 2023.

The total expenditure by the Housing Authority on its various schemes in 2023, which range from rent assistance, homeownership incentives, grants for first-time buyers and subsidies for property renovations amounted to €32.1 million, an increase of 24 per cent from a year earlier.

Reinventing the single market: Strategic vision and bold reforms for Malta and Europe

Proposed reforms present significant opportunities and formidable challenges for our small island nation

The equity market in pre-COVID times

Investor sentiment has evidently failed to recover from the series of shocks since the start of 2020

Interest rate divergence ahead?

Inflation is falling faster than forecast in Europe, while exceeding expectations in the US