Tesla’s share price has continued its route, down a third from its January high, marking the third time in a year the electric car maker’s shares have sunk dramatically.

The share’s dramatic fall reflects a wider one in tech stocks, as the shares that have been the standout performers after a year of COVID falter, with the tech-heavy NASDAQ composite index down more than 10 per cent since its February high.

The decline in Tesla share value can likely be attributed to concerns over rising interest rates, and the dumping of other high value stocks.

On Monday, shares in the company fell over four per cent. This meant they were almost 35 per cent down from their peak on 26th January.

However, despite the plummeting market value, Tesla investors will be reassured that the company has shown itself able to bounce back from similarly dramatic declines in value, having done so twice in the last year.

The stock’s latest dip comes in the wake of a tweet by Tesla Chief Executive Elon Musk on Saturday that revealed an update on the company’s “Cybertruck” will be provided in the second quarter.

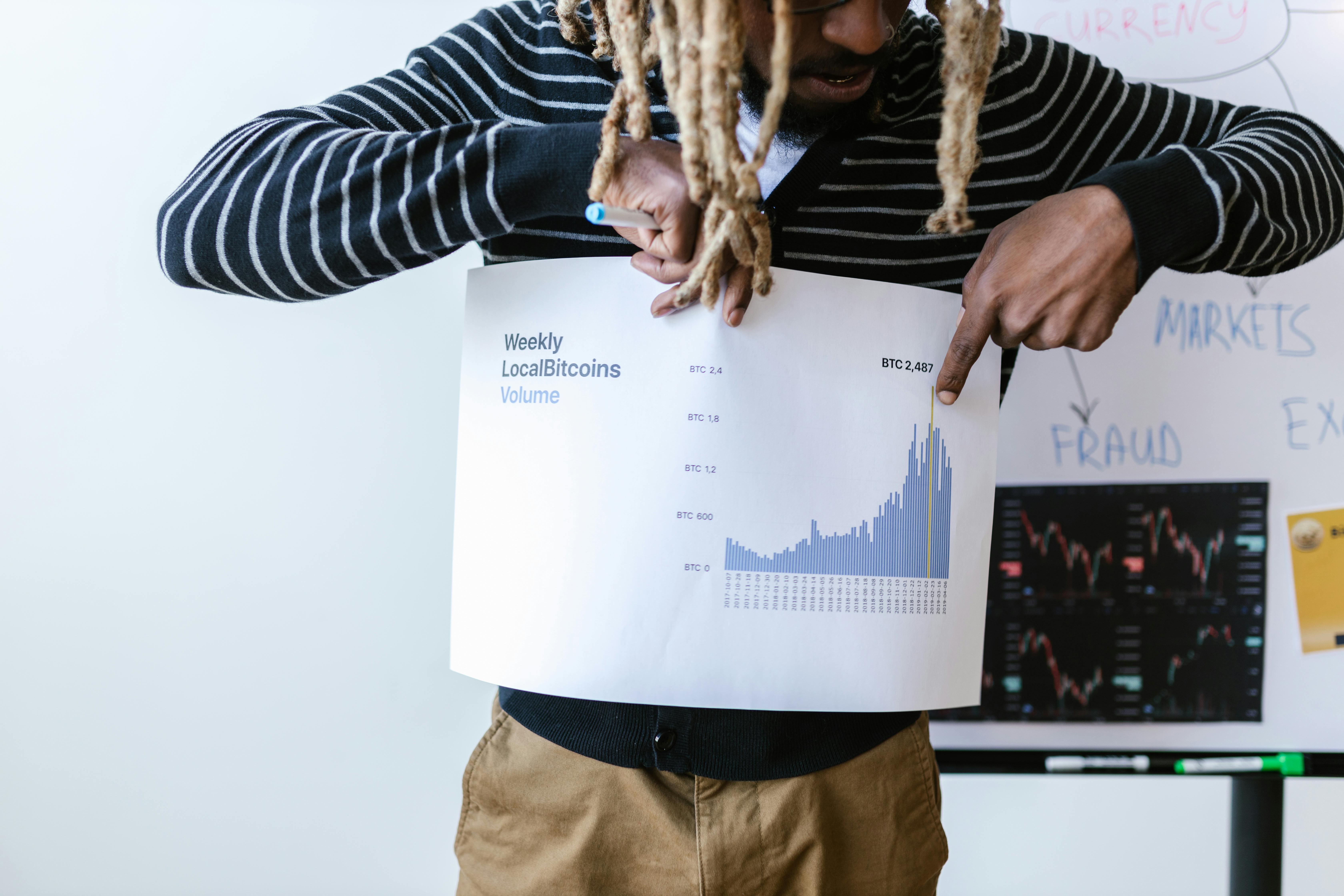

Also notable, is that since Tesla announced it had bought $1.5 billion (€1.25 billion) worth of Bitcoin, its stock has steadily fallen, even while the price of bitcoin has climbed.

Malta’s dramatic increase in cost of living: visualised

Price levels rising from 84 per cent to 93 per cent of the EU average

Malta’s contemporary Japanese restaurant Aki to launch in London this September

The London venue is a Grade II-listed former bank, a stone’s throw from Oxford Circus

Poland to trial 4-day work week, and Greece a 13-hour day. Where does Malta stand?

Europe is debating working hours across the board