Recent statements by the Minister for Finance and Economy, the Opposition, The Malta Chamber, and leading economists all illustrate Malta’s pressing need to focus on high value-added activities.

Economic development via population growth seems to have reached its foreseeable conclusion, as traffic, overdevelopment, and general overcrowding are taking their toll on residents, tourists, and businesses.

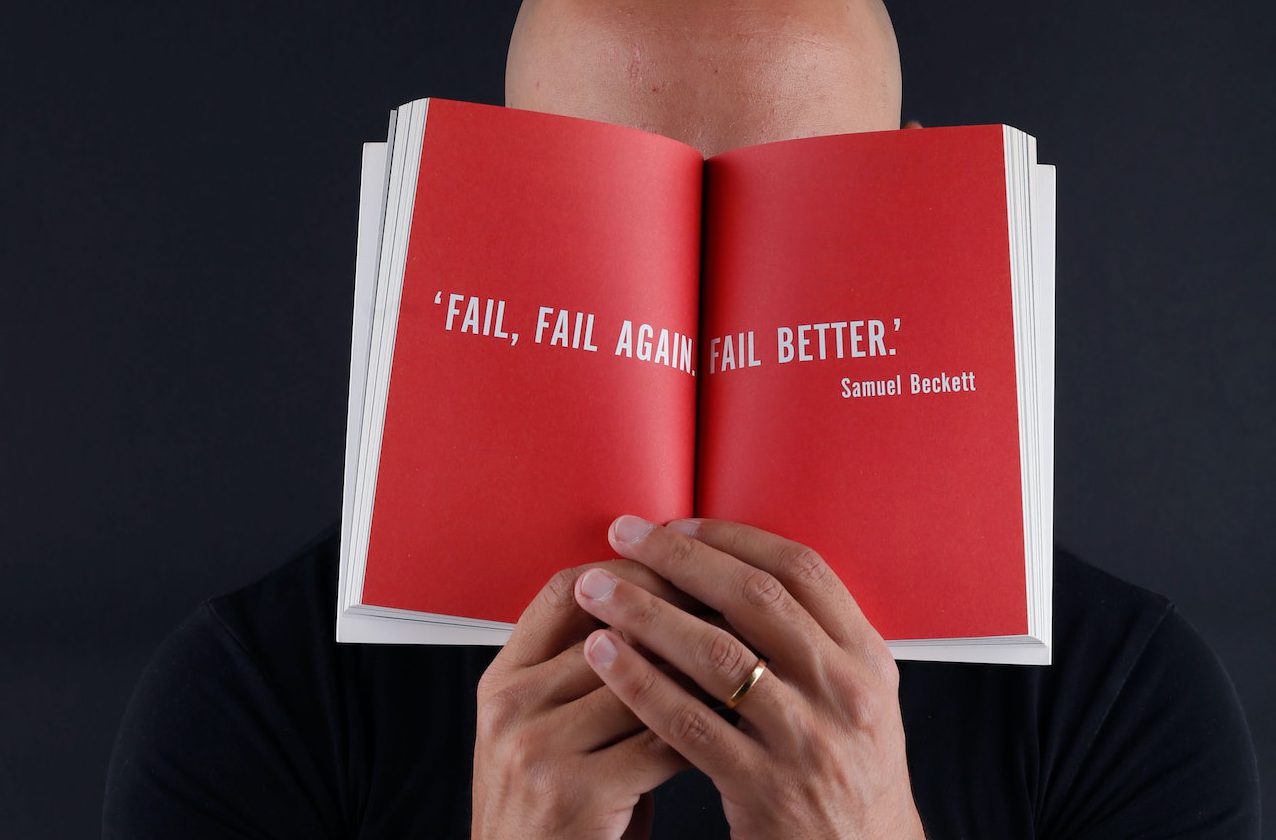

As the country looks to base its future progress on the nurturing of industries that thrive on innovation, creating an environment that supports people and businesses to take the risks required to innovate is more important than ever.

Malta’s track record at attracting foreign direct investment in innovative sectors, such as iGaming and financial services, is a positive one, but when it comes to start-ups, notable successes remain elusive.

The difficulties faced by new enterprises in accessing the capital required to take their project to the next level are well-documented, and efforts by entities like Malta Enterprise are undoubtedly valuable contributions.

Nonetheless, it might be difficult to nurture home-grown innovation if we do not first gain the freedom to fail.

In a recent article by Beppe Coleiro, co-founder of creative and strategic branding agency Blonde and Giant, he outlined the key factors behind start-up success, sweeping away the rags-to-riches mythology surrounding many of the biggest tech entrepreneurs.

One of these – cash – is certainly key to the growth of any company, but its central role in providing entrepreneurs with a safety net in case they fail – and thereby providing the necessary encouragement to help them step into the unknown – tends to be overlooked.

Mr Beppe notes that Jeff Bezos, founder of Amazon, “had half a million in mum-and-dad money just for starters”.

Facebook founder Mark Zuckerberg, meanwhile, dropped out Harvard, noting, upon his return to the esteemed university to deliver a commencement speech, that if he did not feel sure he would have been able to put food on the table should his fledgling project failed, he would have been far less likely to follow his dreams.

“I know lots of people who haven’t pursued dreams because they didn’t have a cushion to fall back on if they failed,” he said. “If I had to support my family growing up instead of having time to code, if I didn’t know I’d be fine if Facebook didn’t work out, I wouldn’t be standing here today.”

He added: “The greatest successes come from having the freedom to fail”.

If you stop and think about it, Mr Zuckerberg speaks sense. A person working long hours to get by does not have the luxury of following their inner passions. A company focused on sure bets will not be willing to take a bet on an unproven idea. And a country wedded to near-guaranteed returns could be blind to the opportunities that await just around the corner.

Importantly, people tend to learn from their mistakes. The US Chamber of Commerce Foundation notes that “entrepreneurs who have endured failure are more likely to succeed in further attempts”.

Nathan Greidanus, a professor at the University of Manitoba Asper School of Business, developed a theory – Positive Entrepreneurial Failure (PEF) which sees failure as a constructive – rather than a destructive – force, although the entrepreneur’s readiness to learn and persevere is a critical element in eventual success.

However it’s packaged, failure is not success. But the former is often an important ingredient in the journey towards the latter, and a culture that leaves no space for failure will find it difficult to find success – innovation depends on it.

Or as Stewart Butterfield, founder of the workplace messaging app Slack, put it: “If you can’t afford to take any risks, you generally won’t take any risks.”

MFSA flags ‘misalignment’ between objectives and public expectations of green loans

Green investment is nonetheless expected to balloon over the coming years

Super rare Ferrari Daytona SP3 spotted cruising along Malta’s roads

The car is currently being traded for a whopping €4 million

Mandatory skills pass for Maltese and EU nationals deferred for a year

The skills pass remains obligatory for third country nationals