Malta lags behind the rest of the eurozone in passing through the European Central Bank’s (ECB) increases to its interest rates on to domestic commercial and mortgage loans, but neither the ECB nor the Central Bank of Malta (CBM) will interfere in local banks’ decisions, says CBM Governor Edward Scicluna.

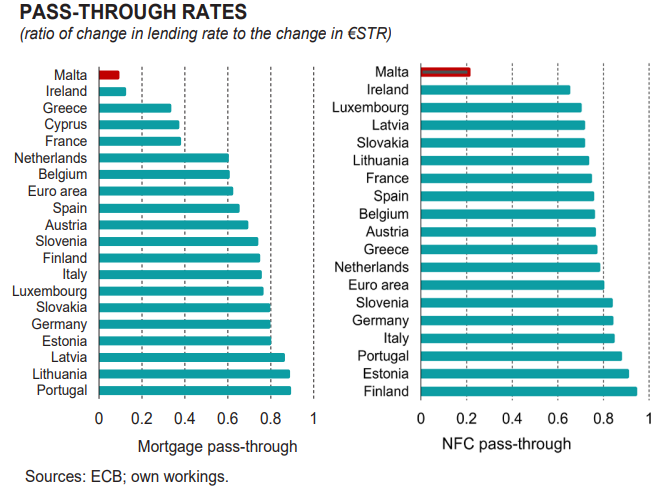

New research conducted by the CBM shows that Malta’s pass-through rate – the ratio of local rate increases to ECB rate increases – is the lowest in Europe.

The mortgage pass-through rate is 0.09 – meaning that home loan interest rates have only risen by 0.09 per cent for every one per cent increase in the ECB’s rates. Only Ireland’s stands comparatively low, at around 0.13.

When it comes to commercial loans, however, Malta’s pass-through rate, at 0.2, is far below second-placed Ireland’s which is around 0.64.

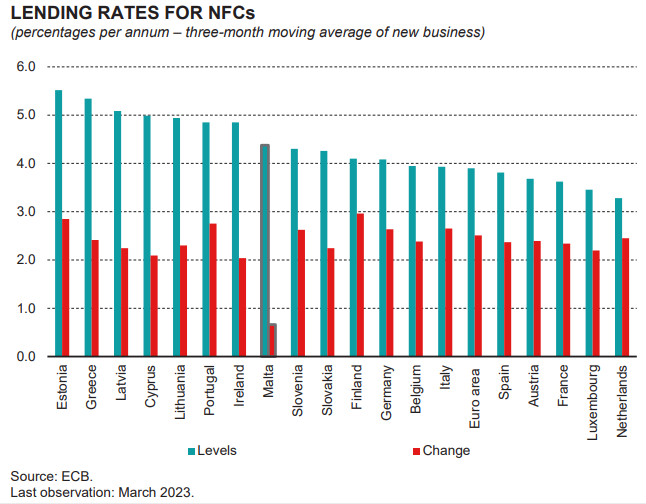

The higher pass-through rate Malta registers in commercial lending means that commercial loans have increased more quickly than have mortgage rates.

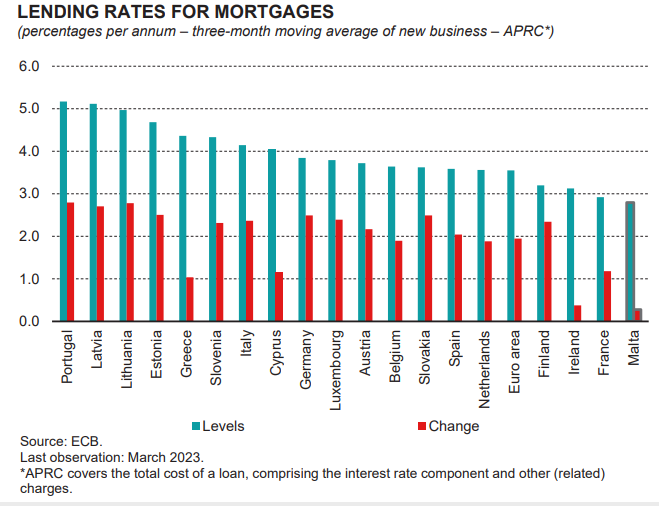

In April, APS Chief Risk Officer Giovanni Bartolotta noted that both home and commercial loan rates were higher than they were in Europe over the last years. However, they have also increased far less significantly over the last year.

In other words, credit in Malta is stable, but it only became (somewhat) cheap in the last few months.

In fact, when it comes to commercial lending, local rates are still higher than the Euro area average, despite registering the lowest increases by a wide margin.

This shows that commercial rates have tended to be high in Malta, and even the far larger increases in commercial interest rates registered in other eurozone countries over the last year have failed to bring them to the level seen locally, which is the eighth highest in the area.

When it comes to mortgages, the picture is rosier for borrowers in Malta, who now benefit from the lowest home loan rates in Europe. A welcome respite, since Maltese home buyers have been subject to rates markedly higher than elsewhere in the currency area since at least 2015.

A recent report found that an increase in the mortgage rate of just 1.2 per cent would price median income households of the market – so local banks arguably have little leeway in this matter.

The low pass-through rate is largely due to local banks’ high level of customer deposits, which shield the local market from the steep interest rate increases seen across Europe.

Speaking to BusinessNow.mt, Professor Scicluna notes that “it is up to each bank, depending on the resulting market conditions, its liquidity situation, and competitiveness to decide whether it would want to change its deposit and lending rates,” adding that “neither the CBM nor the ECB will interfere in this decision”.

Since the rate hikes are the primary mechanism by which the ECB is fighting inflation, Malta’s low pass-through rate effectively mutes this mechanism’s effectiveness on the local economy.

Inflation in Malta has instead largely been kept in check through fiscal policy, not monetary policy, thanks to the Government’s subsidisation of energy and fuel to the tune of €600 million a year – about 10 per cent of its total budget.

However, Professor Scicluna warns that “the fiscal expansionary measure will lead to further fuelling of inflation unless the resulting deficit is not reigned in.”

Similarly, the European Commission has also encouraged Malta to wind down this subsidy, although the Government has so far given no indication of any intention to do so, opting to balance the books by toughening its stance on tax evasion.

Top 5% of taxpayers responsible for one-third of all income tax paid in Malta

On the other hand, the bottom third of income earners pay just 1.7% of all income tax generated

The Malta Institute of Accountants prepares for its 2024 Anti-Money Laundering Conference

Held at the Radisson Blu, St Julians, this latest AML Conference promises to bring exclusive insights on new procedures

Eurozone interest rates to remain unchanged

The European Central Bank noted that price pressures remain persistent